Life Without a Plan

What is financial planning? When somebody says they do “retirement planning,” what does that really mean? Most people would agree with the statement: It is important to have a financial plan.

But when asked, “What exactly does a proper retirement plan look like?” I get a lot of blank stares.

Most “retirement plans” aren’t plans at all.

Over the past 17 years, I have been to countless conferences, meetings, training sessions, and seminars on financial and retirement planning. And after all of that time and effort I have discovered two things:

- 1. Many financial advisors talk a lot about planning, but at the end of the day, the vast majority of their focus centers around portfolio management. Investment portfolio management and retirement planning are not the same things.

- 2. The way financial advisors are taught to execute financial plans is generally WAY overly complicated.

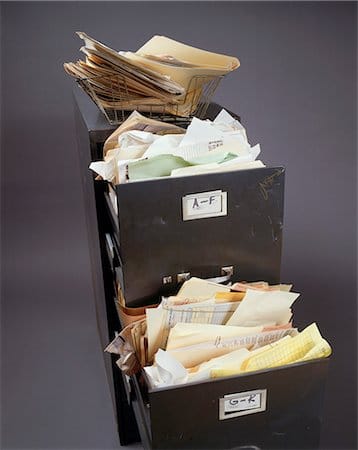

Maybe it’s happened to you. You engage a financial advisor to begin a retirement planning process. After a meeting or two, you are given a two-inch thick binder with incredible amounts of information and data and projections. After about the 5th chart, your eyes start to glaze over.

You may think to yourself: This is too confusing. Forget it.

If you don’t understand your retirement plan, it isn’t a plan at all. It is a binder of information that you toss in the back of your car.

So what IS a retirement plan?

It is the process of taking all of the pieces of your financial puzzle and fitting them together in such a way that your LIFE and MONEY are maximized for your retirement.

At its purest level, it only needs to contain two pieces of information.

- 1. How much money do you need each month to live your life?

- 2. How much money can you safely spend on a monthly basis?

That’s it.

Of course, it’s important to understand how all the pieces fit together. If you don’t, it’s easy to stray off course. If you haven’t noticed there is a lot of “noise” out there when it comes to managing your money.

You need to have a financial plan for retirement that you clearly understand and believe in.

But I have great news. A clear, concise, flexible plan does not have to be 50 pages of indecipherable data and charts. In fact, the financial retirement planning process I’ve developed over the past 17 years only consists of two pages.

Your retirement plan should answer these questions.

- 1. How much am I spending each month now?

- 2. When should I take social security?

- 3. How do I most effectively get my money to work for me once I am no longer working?

- 4. How much money can I safely spend from my retirement savings each month once I retire?

- 5. How much will I have to pay in taxes in retirement?

- 6. What happens if my spouse passes away? What will my finances look like then?

- 7. Do I have any “play” money above and beyond my budget each month? (Can you splurge?)

Retirement planning is about more than money.

Do you want to make sure that all of your money is invested appropriately for your goals and life situation? Of course. But without an actual plan, a well-managed portfolio ends up just being numbers on a piece of paper that do not palpably affect your LIFE.

I can’t tell you the number of times I have sat down with people who have done financial planning but when I ask them any of the questions listed above, they look at me with blank stares.

Retirement planning should be clear, concise, logical, and actionable. It should be a plan not just for your finances, but for your retirement mentality. How do you want to live during your retirement? How will you make that life happen? That’s what your plan should answer.

If you are nearing retirement or recently retired, you are standing at a crossroads. You have two options:

Option 1: Life Without a Plan. The vast majority of Americans take the road where they live their retired lives without a plan. In a sense, they walk around the rest of their days with their hands in the air saying, “I hope this works. I hope I don’t run out of my money. I hope spending money on this trip isn’t a mistake.” This is a pretty crummy way to live your “golden years.”

Option 2: The Winning Way. You can take the time required to put together a plan. It takes a little bit of work, but, I assure you, it is worth it. With a clear plan in place, you are empowered to live the life you deserve, now. You get to live your life with a sense of opportunity and creativity, instead of one of fear. You WIN retirement!

Be Blessed,

Dave