How to Keep Your Kids Close Forever

I’ve harped on beneficiary arrangements in the past, but recently I’ve seen two more messes, and I want to re-emphasize what you need to watch out for.

It is incredible to me. Someone will spend their entire life working to build up some savings. They care for it, nurture it, and watch it grow. But when it comes to deciding who will get the money – the decision lasts about five seconds.

For example:

Mary opens are IRA containing $500,000 of hard-fought savings. She agonizes about how to invest it correctly. She interviews several financial planners. She works hard on a plan that will allow her to live a secure retirement.

When it comes to naming a beneficiary it looks something like this:

Advisor: “So who do you want this money to go to when you pass away?”

Mary: “I don’t know, I guess my husband first and then split it between the three kids.”

That’s it. Thousands of hours creating her life savings. Five seconds determining who gets the financial efforts of her entire life.

Let’s look at some real stories (obviously names and details are changed).

Story #1

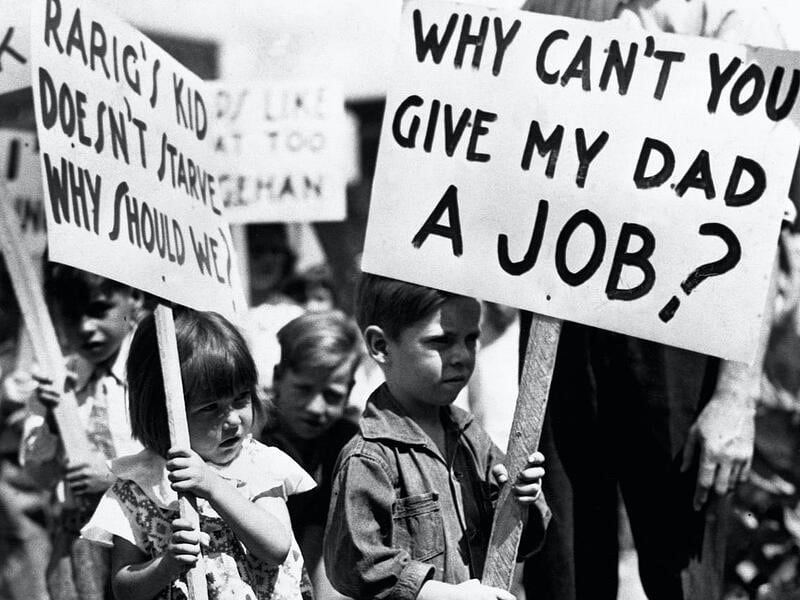

Bill owns a turnip farm in Wisconsin. He worked the farm his entire life. Through acquiring adjacent acreage he was able to buy up nearly a thousand acres of land in order to increase his turnip empire. While the property was worth nearly a million dollars, Bill would never dream of selling- he made a $50,000 turnip profit each year.

What would happen to the farm if he were to pass? His will dictated that his wife would get the property, and next up were the two sons who would share 50/50.

Bill passes away. Mom gets the farm. She wasn’t really sure what to do- as her husband handled the demanding and complex turnip industry.

Suddenly there is some strife in the family. Son #1 is a responsible parent of two and son #2 loves to spend money. Son #1 wants to keep the farm in the family and collect the profits. Son #2 want it sold immediately for a big payday.

So who is caught in the middle? Their mother. The stress it causes in the family creates rifts that might never be healed. And their mother gets stuck being the judge and jury.

Story #2

A widow dies suddenly from a heart attack. In her later years, she became very close to two specific nieces. With no kids of her own, she began to think that maybe it would be best if they received the bulk of the money. They were almost like the daughters to her. It made her feel warm inside to know that all of her hard work could help make her beloved nieces’ lives easier.

Nobody even plans on dying suddenly. At her death, her IRA beneficiary arrangements were examined. The instructions hadn’t been changed in fifteen years. Half the money went to a local political party and the other half was split among ten extended family members. Most of whom she hadn’t spoken to in years.

Story #3

Mr. and Mrs. Smith named each other as the primary beneficiaries on their retirement accounts. Several years later Mrs. Smith passed away. After a few years, Mr. Smith began dating again and eventually married. Mr. Smith just defaulted to his new wife as beneficiary on his accounts. He just didn’t think about it at the time. He was too in love.

Mr. Smith passed away ten years later. The new wife got all of Mrs. Smith’s money even with several kids and grandkids in the picture.

Story #4

The parents of two daughters pass away. On their beneficiary documents, 100% of the money was to go to daughter #1. Why? Daughter #2 was terrible with money and according to Mom, “She would spend it in less than a year.”

Her parent’s idea was that daughter #1 could give daughter #2 money slowly, over time. This way daughter #2 wouldn’t blow the money.

This is a terrible idea. The reasons are obvious. At Thanksgiving, one daughter threw a turkey leg at the other. Would you like it if your sibling could decide when you can get your inheritance? As an aside, a trust could easily fix this situation.

——————————————————-

Lastly, I wanted to share an email I received recently from a client. She gave me permission to share and I hope it reinforces my entire retirement philosophy.

Hi Dave,

I hope you are doing well in the middle of these crazy times.

I’m writing you with a question but first I wanted to thank you for the wonderful advice you gave me to spend and enjoy the money that I have. You’ll be happy to know, I took your advice to heart. After Bob passed away in March of 2019, I decided I would travel somewhere each month. Between April 2019 and April 2020 I traveled to Paris, Copenhagen, Amsterdam, the Maldives, Dubai, California, Texas, New Mexico, Illinois, Michigan, and various places in Florida.

Then things came to a halt with the pandemic. Then for me everything changed drastically when I suffered a compression fracture in my back this summer followed by a diagnosis of multiple myeloma, a cancer of the plasma cells. Needless to say, my life has been turned upside down.

I’m going through treatment now and the doctors at Moffitt say the prognosis is good and people can now live decades with this cancer. I’m so thankful that I followed your advice and enjoyed my money because you never know when life will throw you a curveball.

So, thank you!

Be Blessed,

Dave |