Three Simple Ways to Steal an Inheritance

If one thing could be said about Betty Brown is that she was a hard worker. At age 15 she started working at a drugstore counter, and for the next 43 years, she continued to work a hodgepodge of various jobs.

Betty never went to college and never found employment that paid her a decent wage, but she was tenacious. She worked overtime whenever she could, and would often work another job on the weekend.

Besides a strong work ethic, Betty had also developed one additional habit. She saved money. Oh boy, did she save. Throughout her entire working life, she meticulously put away as much money as possible. She learned how to live on an incredibly slim budget. Betty, financially speaking, had done everything right.

I first met her in her late fifties. She looked tired. “My job is killing me,” she lamented. “They expect more and more work each month without any more help.”

“How much are they paying you?” I inquired.

“$17 an hour. I haven’t had a raise in three years.”

“Betty,” I suggested, “You have nearly $750,000 saved up here. Between social security and the investment income you can derive from the money, you will have plenty each month. In fact, you will have much more money coming in if you quit work and ‘retired’ than you do now.”

“I don’t know Dave, it just doesn’t seem right,” Betty lamented. “I guess I might be ok, but I think I should work a few more years just to be safe.”

Four years later, Betty came in to see me. “Dave,” she said grimly, “I have pancreatic cancer. The doctors are not optimistic, they think I only have a few months to live.”

The doctors’ heartbreaking prediction came true, and within two months Betty passed away and went home. Her $750,000 sat untouched, unused, and unenjoyed.

As Betty had no children, she named her husband as the primary beneficiary on her accounts. But, during the last few weeks of her life, the inheritance became more and more important to her.

She literally spent some of her last days on Earth perfecting her complex and generous contingent beneficiary list: Nephews, nieces, the aunt, and uncle who raised her, friends in need…

Bob Brown, her husband, was in full agreement. After he passed away, he wanted this money to go to the right people.

Unfortunately, contingent beneficiaries don’t hold all that much importance when the primary beneficiary receives the proceeds from the accounts.

Betty’s husband came in to see me shortly after her death. Bob and his wife had never seen eye to eye on their money. In fact, Betty hid most of her financial information from her husband, fearing he may wastefully spend it.

When Bob showed up in my office, along with his brother, I knew Betty’s wishes were in serious trouble. Not only did Bob change all the beneficiaries according to his wishes, but the questions his brother was asking caused me great concern.

“Betty had some sort of hangup about spending money,” Bob’s brother scoffed. “Dave, how much do you think we should start spending now?”

“We”? Since when was Betty’s brother-in-law involved with any of this? In fact, Betty and the brother-in-law had not spoken in years. Betty did not trust him and did not like him.

And now her husband and, ostensibly, her brother-in-law, had her money.

You can guess where this is going. The money was gone in less than a year.

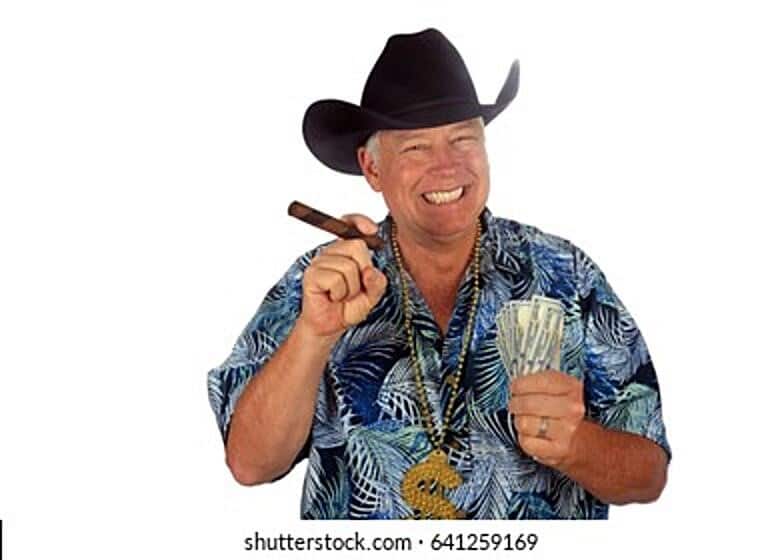

Bob, his brother, and a bunch of their buddies spent a couple months traveling around the world. Classic cars were purchased, gambling losses were significant, bar tabs were large. Good times. They didn’t even have to look at the price.

Betty. A lifetime of struggle. A lifetime of labor. Gone. In hindsight, it was almost like Betty existed as an indentured servant to provide funds for her in-law’s debauchery.

Even as I write this, I feel anger welling up inside of me.

Morals of the Story:

1. Money brings people out of the woodwork.

2. Life rarely moves in a straight line.

3. If you don’t use your money, someone else will. And oftentimes heirs do not use the money the way you had intended.

4. While running out of money in retirement can be a scary prospect, don’t forget that there are other possible conclusions.

Be Blessed,

Dave |