Deflating the Inflation Bogeyman

Inflation. It can be a scary word to retirees. I often hear concerns like, “Dave, I may have enough money coming in now, but what happens 30 years from now when gas is $20 a gallon and a loaf of bread sets me back $25? Am I going to end up living under the highway overpass with feral cats?”

No, you’re not. Don’t want to take my word on it?

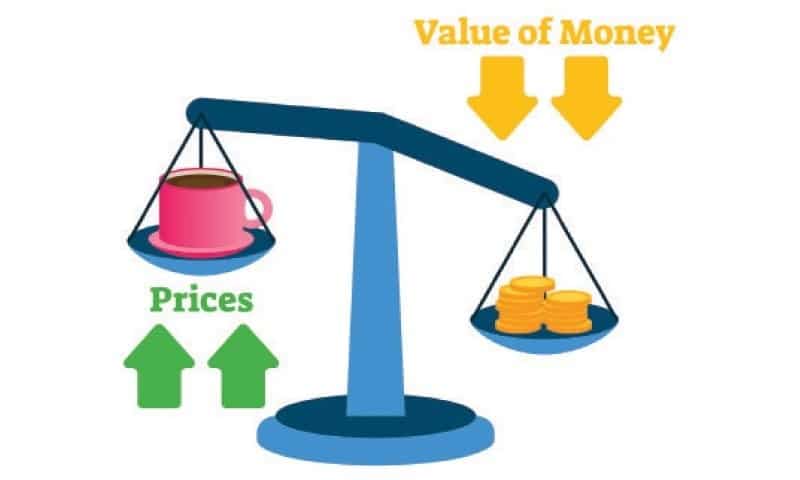

Inflation, historically, isn’t a bank-breaker for retirees.

What were the prices for common goods 25 years ago?

A gallon of milk was $2.88.

A gallon of gas was $1.11.

A stamp was 29 cents.

Those were the days….

If you look back further into the early 1980’s you see inflation really rear its ugly head. In 1979 inflation soared to 13.3% and in 1980 is rose another 12.5%. Do you remember when you could get a CD paying 12%? Mortgage interest rates were also sky high. It was a great time to be a saver but a terrible time to be a borrower.

Since then inflation rates have moderately significantly. Over the past ten years, you saw inflation rates below 3%.

Do you need to worry? Are American retirees going bankrupt due to inflation?

I’ve never seen it, and the data points to the fact that very few retirees experience financial hardship due to inflation.

Why? Two reasons.

As you grow older, you will naturally spend less. In fact, according to the Employee Benefit Research Institute, people over age 75 spend 40% less than those ages 50-65. How could this be?

In the financial industry there is a rather crude saying:

Your 60’s are your go-go years. Your 70’s are your slow-go years. Your 80’s are your no-go years.

As you get older, mortgages get paid off, you buy cars less often, you travel less, spend less on gas, spend less money on food and going out, and you spend less on clothes. In fact, I’ve found that as you get older money means less and less to people. As long as there is enough to meet your basic needs, retirees are happy to live simpler and simpler lives.

The second reason is a big one that most Americans forget. Social security increases lock-step with the rate of inflation. Let’s look at some increases throughout history.

1980: 14.3% increase to Social Security payments

1990: 5.4% increase

2000: 3.5% increase

2010: 0% increase (we were in the middle of recession with no inflation)

Next year: 1.8% increase.

In fact, if you started receiving your Social Security in the year 2000 at $2000 a month, in 2019 your payment would have grown to $3100 a month. Those cost-of-living increases really add up.

This is amazing news! Inflation isn’t the bogeyman you thought it was. It’s just a lot of hot air the media likes to puff up to keep you living scared.

And while we are on the topic of Social Security…

Will the system be solvent? You will end up losing your benefits? Do we need to worry?

I could show you dozens of quotes from actual policy makers and academic institutions. I could show you simply and clearly that you don’t need to worry about the government cutting your benefits.

But instead of proving my argument in that fashion, let’s think about it more logically.

Let’s say that a couple years from now the federal government announces that all Social

Security benefits will be cut by 50% for all.

You do understand that millions of retirees would end up on the streets, right? The political party at the time would never be heard from again. Eighty-year-old women would be protesting on the lawn in front of the White House. The country, socially and economically, would go into a tailspin.

Society as you know it would no longer exist.

It would be FAR more expensive to fix that mess than it would to keep Social Security right where it is. Every politician in Washington knows that fact. Which is why, for all the fear-mongering they do, they are never going to let Social Security go bankrupt.

So be encouraged! You are going to get what you have been promised.

Be Blessed,

Dave