How to make your wife (or husband) mad

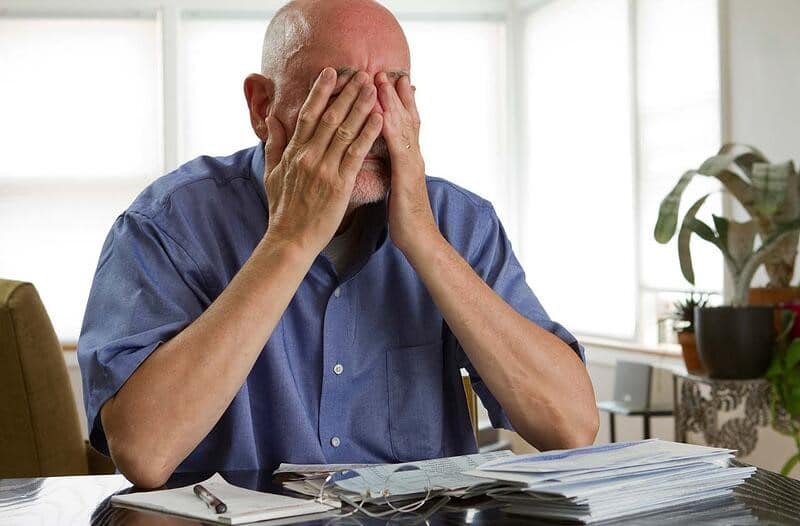

Let’s walk through the thinking process of a newly minted retiree.

This week we look at someone who is going at this all wrong. Next week (stay tuned!) we look at someone attacking the retirement bogeyman with logic and planning.

Let’s expose this faulty way of thinking. How much does the following sound like you?

The following conversation took place between Mr. Jones and his brain shortly before his retirement.

Name: John Jones

Age: 65

Savings: $400,000

Married to Jane Jones, also age 65.

Begin transcript here__

Hmmmmm….. my last day of work is next week. It looks like I will get my last paycheck on Friday.

Ok. With Jane’s social security and my social security we should be bringing in about $3,000 a month. Let’s see…. is that enough? It doesn’t sound like very much.

My property taxes are $2000 a year and my homeowner’s insurance is $2000….car insurance $1,000. Electric bill around $200 a month….

<adding up all his expenses>

Wait a minute, it looks like we are spending about $4500 a month now. Crud. How is this going to work? I have that $400,000 in my IRA, but I can’t touch that. I might run out of money!

I don’t know how this is going to work.

Wait a minute, I have my IRA invested in the stock market. Is that still appropriate for a guy like me? What if the stock market crashes! That guy on the radio keeps saying that we are “due” for a crash. I guess maybe I should put the money in a money market? But that only pays 1%.

Maybe I should get a part time job? I think Home Depot said they were hiring. They pay around $10 an hour. So if I need an extra $1500 a month I would have to work 150 hours.

Wait a minute! 150 hours! That’s a full time job.

Ok John. Think. Think. I am 65 years old. I am probably going to live at least another 20 years. So, if I take the $400,000 in savings and divide that by 20 years, it comes out to $20,000 a year. That is a little more than $1500 a month. That could work.

But wait, Jane’s Mom is still alive at 95. Jane has great genetics. What if I die at 85 and Jane lives another ten years? I can’t leave Jane destitute. She has put up with me for forty years already.

So maybe I should divide my savings into 35 years just to be safe. That gives me about $11,000 a year. So I guess if we cut out our yearly vacation, and stop going out to eat so much, we can get the budget down to $4000 a month. We should be OK then.

But wait! What if one of us gets sick?! What about a new roof, a new air conditioner, and other unexpected expenses? The roof is 20 years old.

Ok. This is getting serious. How is this going to work?!?! We need to have some money set aside.

I guess Jane and I could both go work part time. But our health won’t let us do that indefinitely. Jane is NOT going to be happy if she needs to work a part-time job.

Wait a minute! I’m not even considering inflation. $4,000 a month may not be enough in ten or twenty years. What are we going to do then?!

I need a stiff drink. I feel my chest tightening. Maybe I should turn on the financial news channel to get some ideas….

End of transcript….

Actually, Mr. Jones is in much better shape than he realizes.

Tune in for Part 2 next week.

Have a Blessed Week,

Dave

No comments:

Post a Comment