Have You Done Your Homework?

You need $1,000,000 to retire, right? Not in my experience. Many people are surprised how little money is needed monthly in order to afford a comfortable lifestyle once you retire.

I have done retirement budgeting with hundreds of people in the Sarasota area, and today I am going to review some of my conclusions.

First, let’s take a look at a normal retirement budget.

Here are items (and approximate cost) that I see on almost every budget.

Assumptions:

- Married couple

- No mortgage

- Live in single family home

- Have one car they are still paying on

- Go out to eat once a week at a nice restaurant

- Annual expenses are shown monthly

- Take a nice vacation each year

| Budget Item | Cost |

| Mortgage | n/a |

| Property Taxes | $300/mo |

| Home Insurance | $200/mo |

| HOA Fees | n/a |

| Electricity | $250/mo |

| Water/Sewer/Garbage | $70/mo |

| Cell Phone | $100/mo |

| Cable/Internet | $200/mo |

| Pest Control | $50/mo |

| Lawn Service | $100/mo |

| Maintenance/Repair | $200/mo |

| Car Payment+Insurance | $500/mo |

| Gas | $100/mo |

| Auto Insurance | $150/mo |

| Groceries | $500/mo |

| Eating out | $400/mo |

| Clothing | $100/mo |

| Beauty/Barber | $150/mo |

| Vacations | $400/mo |

| Gifts/Tithes/Charity | $200/mo |

| Medicare Premium | $134/mo per person ($268) |

| Medicare Supplement | $200/mo per person |

| Dental | $50/mo |

| Miscellaneous | $200/mo |

| Total | $4700/mo |

Surprised? Most people are.

I know some of you are going to fight me on those numbers, but hopefully you get the idea.

If you don’t have a mortgage, almost everyone falls into the category of needing $3000-$6000 a month once they are retired. And this pays for a nice life! You’re not staying at home with the air conditioner set to 80 degrees. You are not eating beans out of can for dinner. You are leading a full and active retired life.

Of course, your situation may be different. If you still have a mortgage, add that to the total. Maybe you don’t have cable. Maybe you spend more money on eating out.

The point I’m trying to make is this: Most Baby Boomers nearing retirement have no budget and no real idea of what their expenses will be once they retire. I hope this gives you a better handle on the numbers.

Quick note- Remember that it is important to have an emergency fund. Your roof may need replaced, your air conditioner will break down, and dental work can be ridiculously expensive. These expenses are not included in this budget.

Retirement financial facts you need to know.

Let’s speed-round a few points about retirement and money that you absolutely need to know so you can retire with confidence.

#1 You don’t need $1 million to retire. I know I say this constantly. But I’m going to say it again. Most people can retire comfortably with far less than a million bucks in the bank.

Glad we got that one out of the way up front. Here are a few more.

#2 Social security is more than you think. The average social security check is around $1500 a month. So if you are married, that $3000 could cover more than half of your living expenses. In fact, I’ve met many frugal people who are living a very full life on $3000/mo.

#3 It can be fun reducing your expenses. Seriously. Look for restaurant specials. There are all kinds of ways to save money on clothing, furniture, and food. Be creative. Make a game out of it. You never need to pay retail again. 🙂

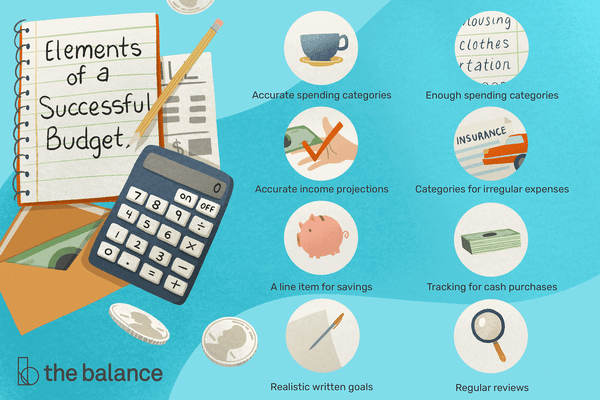

#4 Budgeting is a lifelong habit. Many of you with modest incomes have adjusted to living below your means over the years. People like you often have a much easier transition into retirement.

I’ve found six-figure earners often have a much more difficult time adjusting. Most people who bring home $10,000 a month are used to living on $10,000 a month. You would need a huge amount of savings to continue that kind of lifestyle.

Your homework assignment: A retirement budget.

So now it is time for you to make your retirement budget. I would encourage you to go through the same exercise I just took you through and use your real numbers.

Making a budget for retirement can be incredibly empowering, and for most people, it gives them relief. Relief knowing that maybe you don’t need to worry so much about money. And if your budget needs a little trimming, at least you know.

Be Blessed,

Dave

No comments:

Post a Comment