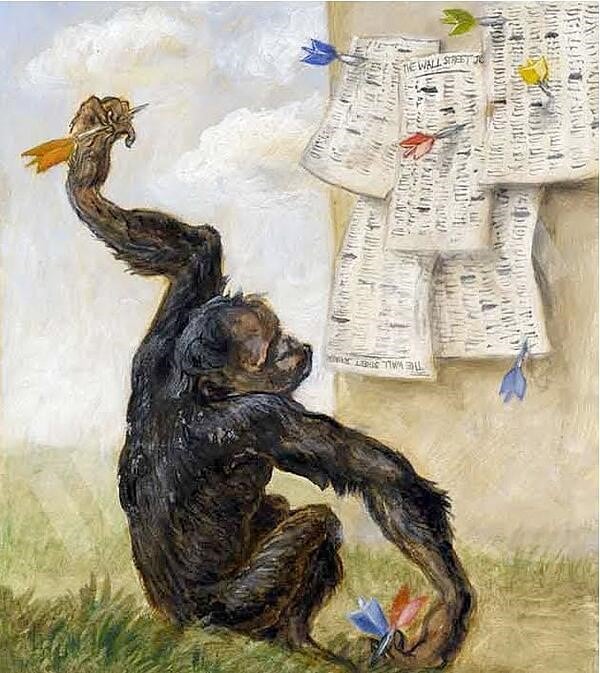

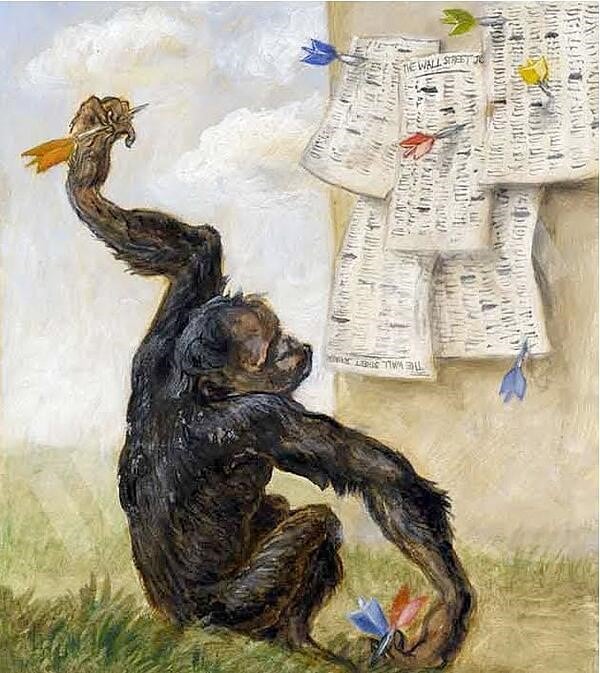

I am getting more and more calls about the impending doom of the stock market. Why would people like you get the idea that the stock market is “due” for a crash? Why do people like you feel the need to worry? It’s because you’ve been trained by the financial media to believe so. You are only hearing one side of the story. I obviously don’t have a crystal ball, but I could just as easily argue: The pace of innovation is incredible. We are seeing entire parts of the economy reinvent and improve themselves at light speed. It would be totally reasonable for me to say: “In the next ten years we will experience the largest market increase in the past 100 years.” So why does everyone have such a “glass half empty” attitude towards their investments? It’s because these pundits are completely guessing, but make it sound like they are smart. Below I am going to show you some articles I’ve found over the past week alone. October Stock Market Outlook: Is The S&P 500 Ripe For A Correction? Dave’s angry comment: The main thrust of the argument is that October is a notorious month for poor stock market performance. But this is completely misleading. In the past twenty years there were two significant downturns, both of which happened quickly, and both of which just happened to be in October. It has created skewed long-term results. It was pure chance. When to Expect the Next Stock Market Correction, According to Investment Pros Here’s a doozy: “A stock market correction is coming. There is no way to say for certain whether or not we’re already at the beginning of the correction (generally considered a dip of 10% to 20% in stock prices), but experts say one thing is for sure: it’s coming at some point.” Dave’s angry comment: And with all due respect, the writer (Mallika Mitra), is in her early twenties and has been writing for Money magazine for less than a year. Why are we letting her article give us heartburn? The odds of a 20% correction in stocks are rising as the market transitions to the next stage of its cycle, Morgan Stanley warns The main issue I have with this one is that they use such confusing language. The average reader would have no idea what they are talking about. And it’s very easy to think, “If Morgan Stanley thinks this is going to happen, and since they know how to use a lot of fancy words, it must be true.” It’s not true. It is pure speculation. The article should say, “Morgan Stanley hired a monkey to throw darts at an investment chart on the wall. This is what it said.” As stocks soar to historical highs, some experts say conditions ripe for correction My main issue with this is the source. For many people, ABC News is a very reliable place to get your news (a lot of people would not agree with that). The trick used here is employing the opinions of very fancy people. Namely, a Yale professor and a professor from the Wharton School of Business. The Yale Professor got really lucky and predicted the Dot.com bubble in 2001. Since then he has been treated as investing royalty. If he is so smart, why doesn’t he invest his own money and become fabulously wealthy? Professors don’t exactly make the big bucks. As our population ages, future stock market returns will be lower. Here’s a metric to watch I see these articles often and they drive me absolutely crazy! They always go something like this: “Going forward we can’t expect the same returns as the past because of blah blah blah.” Ok. Maybe the stock market won’t make 10% like it has for the past 200 YEARS. If between now and the end of your life, the stock market does not return around 10% is would be historically unprecedented. But I don’t want to do what these other guys are doing. I am also “guessing.” I don’t want to give you the impression I know any more about the future than anyone else. But I would argue my guessing has centuries of sustained proven results. You have to bet on something when you invest your money. I’m betting on what got us here. I read the same kind of articles in 2010 and the market averaged 15% a year for the next decade. We’re in a massive market bubble. When it pops a lot of investors will get wiped out This is another very common trick and I believe it to be the most underhanded. The author, Frank Giustra, runs a company that sells investments. The more air time he gets, the more he appears legitimate. The more he appears legitimate, the more investments he can sell. Negative, scary news always gets the most attention. Mr. Giustra is well-known for making scary predictions about gold, bonds, stocks, real estate, global markets, Bitcoin… basically anything. Who gave him the right to financially damage good people like you? There were people who read this article and literally moved their portfolios around. These articles are not a victimless crime. They cause real people to make bad emotional decisions about their money. Ok. I guess that’s enough ranting for this week. Be Blessed, Dave Presenting: Ask Dave Anything I wanted to give back to the community. So I’ve started scheduling short, free phone calls, where I will answer any financial questions you may have. Spots go pretty fast. Click here to get your spot |

No comments:

Post a Comment