Temporary Losses and Permanent Gains

Family Update

We came back from Pittsburgh on Monday. I’m glad to be working in my office again instead of remotely. When we got back our puppy went completely nuts. I have never seen an animal express that kind of joy before. Every year we also measure all the kids. My middle son, Alex, just turned 12 and he grew more inches than anyone else. I would also like to point out that my wife is incredibly patient and kind. Do you want to know what it looks like to move a six-person family?

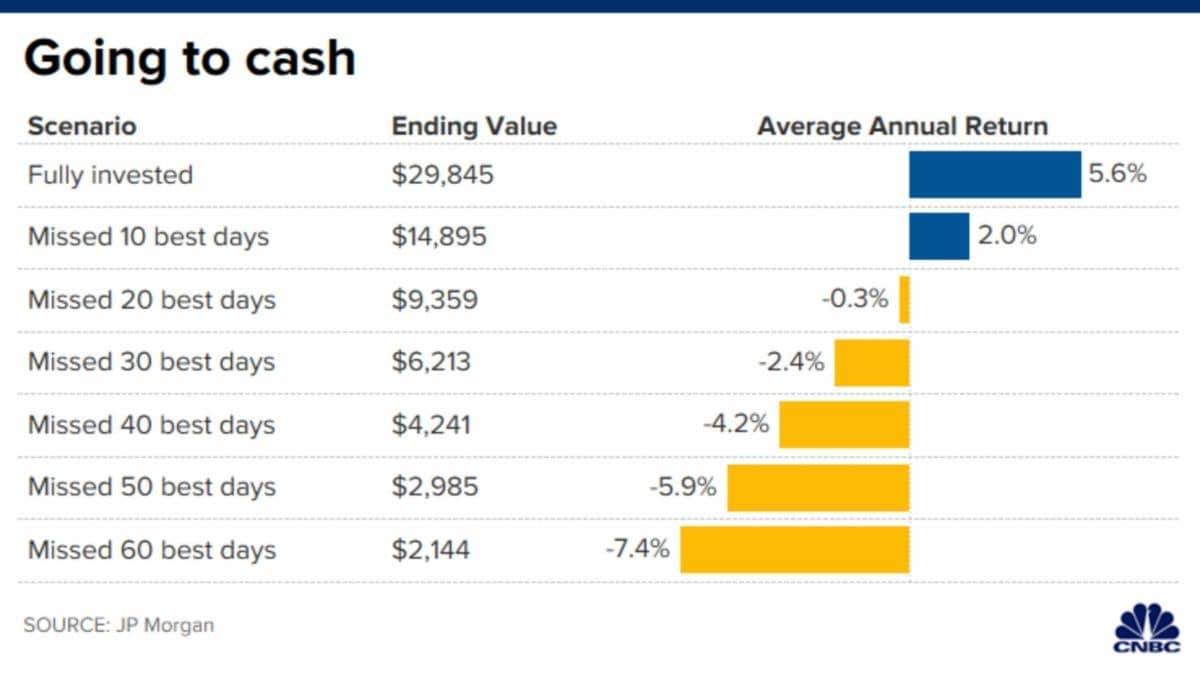

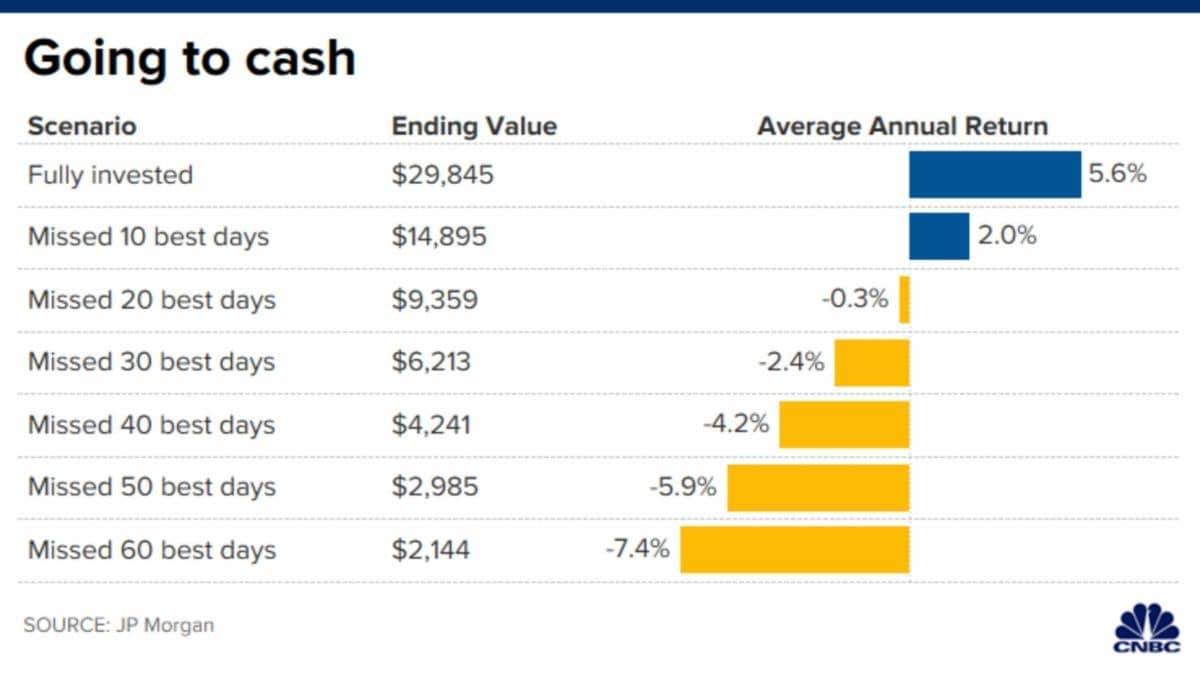

Should I Sell My Stocks?Clearly, with the current economic situation, I am here to be the voice of reason. First of all, I want you to say to yourself (out loud if you so choose): Markets temporarily go down and permanently go up. As you can imagine, I’m getting the same questions over and over again. Here are the answers to some common ones: Common Question #1 “Dave, I’m taking money from my portfolio each month. Do I need to stop that disbursement since the market is down?” No. Remember, we are assuming an average of 5%. Did you get more money last year when the market was skyrocketing? No. You get what a diversified portfolio has averaged. Common Question #2 This time is different. What do we do Dave? This time isn’t different. I wrote an article about this about a month ago if you need to refresh your memory. Common Question #3 “Do I need to worry?” No. This volatility has zero bearing on your long-term financial future. Common Question #4 I’m too old to invest. This is all I have. What do I do? It is very easy to remember when the stock market goes down, but most people do not remember that the Dow Jones was 21,000 during Covid and now it is at 30,000. If you give into the fear, and put all of your money in cash, you are actually increasing your chances of running out of money. The most important variable when it comes to retirement planning is the fact that your money keeps working for you. Common Question #5 “Should I get more conservative with my investments until this all blows over?” No. I’m going to give you cold, hard data that will debunk the concept that timing the markets in this situation might help. I want you to know that I am not remotely worried. I’ve been through this before and it always ends the same way. Betting against innovation and progress is ALWAYS a mistake. Here is a profoundly important chart. |

|

|

What does this mean? The chart is pointing out that, from 2000-2020, the stock market had averaged 5.6% per year. But if you missed the 10 best days, you would have lost two-thirds of the overall profits. Think about that! Out of 7,300 days, missing the best ten, you decimated your long-term returns. You cannot time the market. I often hear, “I’m going to wait until things settle down.” When is that exactly? After the market has two amazing days, or three? Oops, you just messed up your whole life-long investment strategy. You can do this! Be Blessed, Dave |

|

No comments:

Post a Comment