COMMENTS

Is there any hope?

FAMILY UPDATE

My daughter had her sweet sixteen party this week. We hung out at the beach with her friends and even hired fire dancers. She is so beautiful and kind. I'm proud to be her Dad.

She is also going to take her driver's test this week. She doesn't need to parallel park or anything. But we've been hitting the roads (even the highway). I think she is fully prepared.

We have never given our six-month-old puppy a haircut We've been told that once he gets that first cut he will never be that soft again. I think it's time. I don't know how he even sees through the fluff.

Please read through the following statements and check the ones that apply to you. If you need more information on the topic I have linked past articles.

__ I look at my phone daily to see what the stock market is doing.

--- Whenever I hear someone on TV prognosticating, I say to myself, I better listen carefully. They are wearing a suit and have a nice haircut.

---I am afraid that the stock market will crash and my account will go to zero.

---This time is different. The world economy is more uncertain than at any other time in history.

---I am not going to spend any money from my retirement accounts unless I absolutely have to.

---Social Security is going insolvent. I cannot rely on it to be there throughout my retirement.

---While on Medicare, if I have a $300,000 medical bill from heart surgery it will bankrupt me. (Not true, the maximum out-of-pocket is $6700 a year)

---Unexpected retirement expenses will ruin my retirement.

---I know that my family will get along when they receive any sort of inheritance.

---I will only spend money from my retirement savings once retired unless I absolutely have to.

---I am too old to invest. I need to stick with CDs and savings accounts.

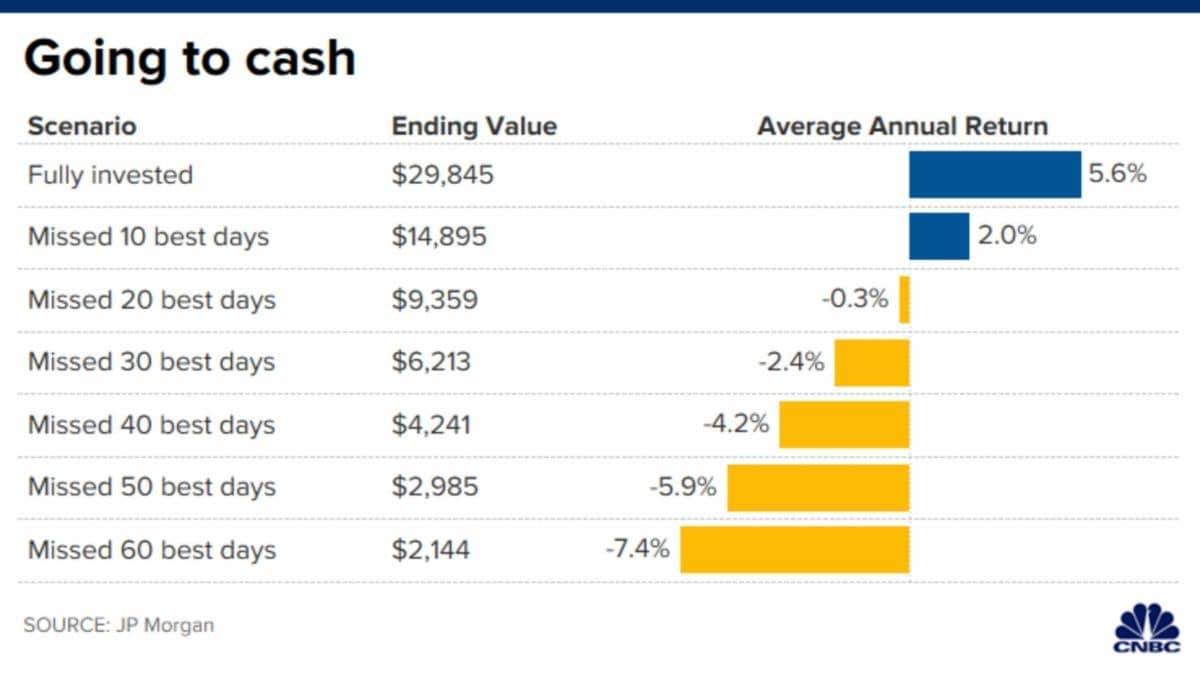

---I believe that I need to take my money out of my investments while this “blows over.”

---Buying physical gold off of a TV commercial is a great idea.

----If I spend enough time studying the market, I can make a lot of money trading in and out often.

---I will spend a lot more money in my 80’s and 90’s than in my 60’s and 70s.

__I go to as many “steak seminars” as possible.

---I’m afraid of being generous with my money because I might run out.

__I don’t have a will, power of attorney, and healthcare proxy.

---I am going to stop putting money into my 401k when the stock market is going down.

__I need a million dollars to even consider retiring.

---I know that taxes will eat me alive in retirement.

__I make sure to read any financial article with a scary title.

0-5 Great work! You accurately understand the complexities of retirement finance and planning.

5-10 Uh oh. You have some misconceptions that need to be addressed. It might be helpful to click on some of the links above to correct some of your thinking.

10-20 Danger! Danger! You may be living scared for no reason. You need to do some homework (and read some past articles) so that you don’t make significant mistakes with your retirement finances and lifestyle.

20-22 I’m afraid there’s no hope for you.

Be Blessed,

Dave